Which e-payment providers are there? The most popular e-payment systems, their benefits and drawbacks.

Digital wallets (Paypal, Apple Pay, Google Pay, Samsung Pay)

A digital wallet, also known as an e-wallet or mobile wallet, is a digital version of a physical wallet that allows users to store, manage, and spend their money electronically. Some of the most popular digital wallets include PayPal, Apple Pay, Google Pay and Samsung Pay.

And although they belong to the same type of payment method, there are a few differences between them. In this chapter, I want to explain to you what the differences are in the three most popular apps.

Let’s start with Paypal. There are several ways you can use Paypal. You can register online at paypal.com. If you have an iPhone, you can download the app of the same name from the Apple Store. If you have another smartphone, your phone probably uses the Android operating system, and you can download the PayPal app from the Play Store. You connect your PayPal account to a credit card, debit card or bank account. Once you have done this, you can pay with PayPal at many online shops. One advantage of PayPal is that you can easily send money back and forth with other PayPal users by entering your email address.

Apple Pay works a little differently. You can only use Apple Pay with Apple smartphones. And unlike PayPal, you cannot connect the desired means of payment directly to Apple Pay. You have to use the pre-installed Wallet app. Here you can also only add credit or debit cards and not a bank account. The advantage of Apple Pay is that you can also use it to pay in local shops. To do this, you need a smartphone or smartwatch that has the so-called NFC technology (See 3.2 for more information!). Another advantage of Apple is that you can store train tickets or admission tickets in the Apple Wallet just like in a real wallet. You can’t do that with PayPal.

Google Pay essentially works in the same way as Apple Pay. It can be used on all devices that run the Android operating system. That should normally be all devices that are not from Apple. On the one hand, there is Google Wallet, where you can deposit credit or debit cards or store tickets. And on the other hand, there’s Google Pay, which lets you pay online and on the spot wherever it’s accepted. Unlike Apple Pay, however, you can also link your Google Pay account to PayPal. The main difference between Google and Apple is where the data is stored.

To sum up, the main advantage of using digital wallets is that they are convenient and easy to use. And unlike physical wallets, which can be bulky and difficult to carry around, digital wallets can be accessed from a smartphone or other electronic device, allowing users to make purchases or transfer funds quickly and easily.

Paying be phone or smart watch using NFC

Paying with Near Field Communication (NFC) allows you to make purchases by simply tapping your smartphone or payment-enabled device against an NFC reader. This technology is becoming increasingly popular and is available through a number of apps and devices.

Paying with Near Field Communication (NFC) allows you to make purchases by simply tapping your smartphone or payment-enabled device against an NFC reader. This technology is becoming increasingly popular and is available through a number of apps and devices.

NFC payment works by transmitting a radio frequency signal from your device to a payment terminal when you hold your device close to it. The payment is then processed through your linked debit or credit card. You can use NFC payment for a variety of purchases, such as buying groceries, taking public transportation or paying for parking.

There are several apps and devices that support NFC payment. The most popular apps include Apple Pay, Google Pay and Samsung Pay. These apps are available on most modern smartphones, including the iPhone, Samsung Galaxy and other Android devices.

One of the main benefits of NFC payment is convenience. It is quick and easy to use, as you can simply hold your device up to the payment terminal to complete the transaction. NFC payment is also secure, as it uses advanced encryption technology to protect your payment information.

Another benefit of NFC payment is that it is widely accepted at many retailers and businesses, including supermarkets, restaurants and convenience stores. This means that you can use it to make purchases almost anywhere you go.

One potential drawback of NFC payment is that it may not be available at all retailers or businesses. While it is becoming increasingly popular, some smaller or older businesses may not yet support NFC payment.

Another potential drawback of NFC payment is that it requires a linked debit or credit card, which may not be ideal for those who prefer to pay with cash or who want to avoid using credit. It is important to consider your personal preferences and financial situation before using NFC payment.

Overall, NFC payment is a convenient and secure way to make purchases using your smartphone or other NFC-enabled device. With the availability of apps like Apple Pay, Google Pay and Samsung Pay, it is becoming more widely accepted and is a popular payment method for many people.

Credit Card and Domestic debit card

Example for credit cards

Example for domestic debit cards

Indicates whether a card supports contactless payment.

Credit cards are a type of electronic payment that allows people to pay for things without using cash or checks. When you use a credit card, you give the merchant your card information, and they send it to the credit card company to make sure you have enough money. You can use credit cards online to pay for your hotel stay up front or in some stores. If the transaction is approved, the money is taken out of your credit card account, and you get a confirmation of your purchase.

Credit cards are easy to use and accepted at many places, including online stores. Some credit cards also offer rewards, such as cash back or points, which can save you money.

However, there are also some drawbacks to using credit cards. If you don’t pay your bill in full each month, you will be charged interest and fees, which can add up quickly. Credit cards are also at risk of fraud and identity theft, so it’s important to keep your card information safe.

The most common credit card providers are Visa, Mastercard, and American Express. These providers offer similar services, but they may have different benefits and fees. It’s important to read the fine print before choosing a credit card to make sure it’s the right fit for you.

A domestic debit card is similar to a credit card in that it allows you to make electronic payments. However, with a debit card, the money is taken directly out of your bank account, rather than borrowing money like a credit card. Debit cards are often provided by your bank or credit union, and they can be used at many of the same places as credit cards. However, they do not offer rewards like credit cards, and you cannot spend more money than you have in your bank account. It’s important to keep track of your spending with a debit card to avoid overdraft fees.

Online Banking

Online banking is a type of electronic banking service that allows you to manage your finances from your computer, tablet or smartphone. Instead of visiting a physical bank branch, you can access your account online via a browser like Google Chrome or use the app of your bank and perform transactions from the comfort of your own home or on-the-go.

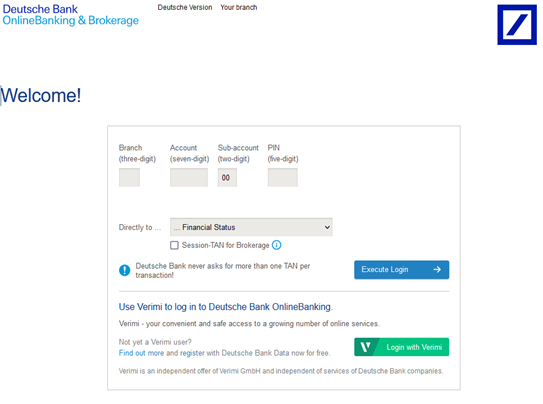

Example of a Log-In screen for Online Banking:

How does online banking work? To use online banking, you need to sign up for an account with your bank and create a username and password. Once you have logged in, you can view your account balance, transaction history, transfer money, pay bills and more. You can also set up alerts to notify you of any account activity, such as when a deposit or withdrawal is made.

Benefits of online banking: One of the main benefits of online banking is convenience. You can access your account and perform transactions 24/7, without having to leave your home or wait in line at a bank branch. Online banking is also generally more efficient than traditional banking, as transactions are processed in real-time and do not require manual processing. This means that transfers and bill payments are typically processed faster and with fewer errors.

Another benefit of online banking is that it can help you to manage your finances more effectively. You can view your account balance and transaction history in real-time, which can help you to keep track of your spending and identify any unusual activity. Online banking also allows you to set up automatic transfers and bill payments, which can help you to stay on top of your bills and avoid late fees.

Drawbacks of online banking: One of the main drawbacks of online banking is the risk of cyber threats, such as hacking, phishing and identity theft. It is important to take precautions to protect your account, such as using strong passwords, not sharing your login details and being cautious of suspicious emails or websites.

Another potential drawback of online banking is that it may not be suitable for everyone, particularly those who are not comfortable using technology or who prefer to interact with a person at a bank branch. It may also be more difficult to resolve issues or errors that occur with online banking, as you may not have direct access to a bank representative.

Overall, online banking can be a convenient and efficient way to manage your finances. However, it is important to be aware of the potential risks and to take steps to protect your account.

Gift cards

Gift cards are preloaded cards that can be used to purchase goods or services from specific retailers or businesses. They are usually sold in-store or online and can be given as gifts or used to manage your own spending. There are gift cards for a variety of services, the most popular ones being amazon, spotify, netflix or steam.

How do gift cards work? When you purchase a gift card, you pay a certain amount and receive a card with that value preloaded onto it. The recipient or cardholder can then use the card to make purchases at the designated retailer or business up to the card’s value. Gift cards usually have expiration dates, so it is important to use them before they expire.

Benefits of gift cards: One of the main benefits of gift cards is convenience. They make great gifts for birthdays, holidays or special occasions, as they allow the recipient to choose their own gift. Gift cards are also a good option if you want to manage your own spending, as they can help you to stick to a budget or limit your spending in a particular store or business.

Another benefit of gift cards is that they are usually easy to use. You can simply swipe or scan the card at the point of purchase, and the value of the card will be deducted from the total cost of your purchase.

Drawbacks of gift cards: One potential drawback of gift cards is that they may have fees or expiration dates that reduce their value over time. It is important to read the terms and conditions carefully before purchasing a gift card to ensure that you understand any fees or restrictions.

Another potential drawback of gift cards is that they may be lost or stolen, which can result in the loss of the card’s value. To protect your gift card, it is important to treat it like cash and keep it in a safe place.

Overall, gift cards can be a convenient and practical way to manage your spending or give gifts. However, it is important to be aware of any fees or restrictions associated with the card and to take steps to protect its value.

Which payment option is the right one for me?

When deciding which e-payment option is the best one for you, there are several factors that you should consider. Some of the key factors to consider include the following:

- Acceptance: The first thing to consider is whether the e-payment option is accepted at the merchants or locations where you want to make purchases. Not all e-payment options are accepted at all merchants or locations, so it is important to choose one that is widely accepted to have flexibility and convenience.

- Fees and charges: Another important factor to consider is the fees and charges associated with the e-payment option. Some e-payment options may have higher fees or charges than others, making them more expensive. It is important to compare the fees and charges of different e-payment options to choose the cost-effective one for your needs.

- Rewards and benefits: Some e-payment options may offer rewards and benefits, such as cashback, points, or miles, which can provide additional value for your spending. If you are interested in these types of rewards and benefits, it is important to choose an e-payment option that offers them.

- Security: Security is an important factor to consider when choosing an e-payment option. Different e-payment options may have different levels of security, so it is important to choose one that offers the level of security you are comfortable with.

- Convenience: Finally, consider the convenience of the e-payment option. Choose an e-payment option that is easy to use and fits your lifestyle and needs. This will make it more likely that you will use it regularly and get the most value out of it.